Expense Reporting

U-M pays for reasonable and necessary business expenses. A ‘necessary expense’ must have a clear business purpose and be within U-M’s expense policy limitations. The business purpose must support or advance U-M’s missions of education, research, and patient care and describe the expense as necessary, reasonable, and appropriate.

Employees:

- Reimbursements and reconciliation of PCard expenses must be processed in the Expense Reporting tool, Emburse Enterprise (formerly known as Chrome River).

- The employee can create the report, attach supporting documentation (receipts, etc.) and submit the report for approval and processing. Prior to reporting expenses, submitters should be familiar with Expense Reporting Best Practices.

- Students who are also university employees should use Emburse Enterprise for any employment related expenses and submit a TBHER or Payment Request Form for expenses related to their academic pursuit.

Non-employees (guest/student):

- Reimbursements for travel and hosting expenses must be processed using a Travel and Business Hosting Expense Report (TBHER).

- For non-travel/hosting related reimbursements, use the Payment Request Form. This information is entered into M-Pathways, creating a voucher to process the payment. To comply with IRS requirements, the reimbursement recipient must sign the TBHER or Payment Request Form, either physically or digitally (eg. SignNow).

Announcements

New Expense Reporting Tool – Emburse Enterprise (formerly named Chrome River)

The University of Michigan upgraded its expense reporting system to Emburse Enterprise on August 1, 2024.

- TDx KnowledgeBase: Bookmark the KnowledgeBase landing page for easy access to work instructions and additional support.

- Expense Approvals: Read this article for more information on the single expense report approver approach in Emburse Enterprise.

- Expense System Reporting: Learn about the various Tableau and Business Objects reports available for reviewing Emburse Enterprise data.

Accessing Old Concur Reports

The Concur Report Grabber tool is now available for employees to access PDF copies of their past expense reports, including receipt images. For additional help, refer to Obtaining PDF of Concur Reports.

Upcoming Events

Virtual sessions for U-M expense reporting questions

U-M representatives will be available to answer your questions.

- April 9, 2025 – 2 pm – 3 pm – Training/Demo session – Add to calendar

- May 13, 2025 – 2 pm – 3 pm – Training/Demo session – Add to calendar

The Zoom link and passcode below can be used for all sessions:

https://umich.zoom.us/j/97330976833

Passcode: 253097

Expense

Resources

Emburse Enterprise Expense Tool

Emburse Enterprise

Best Practice

Trip Optimizer

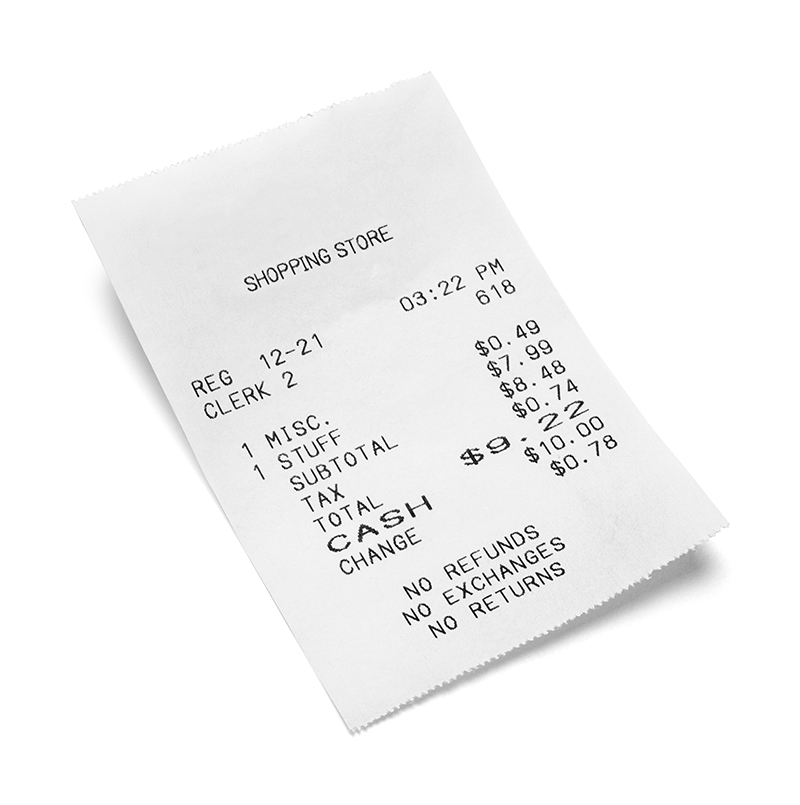

Receipt Requirements

A proper receipt is original, shows the itemized description of the items purchased, the date of purchase, and the amount paid. It is the employee’s responsibility to obtain original itemized receipts from the merchant. Packing slips are acceptable if they are itemized.

Itemized receipts are always required for the following:

- Expenses $75 and over

- Airline or rail tickets

- Hotel, Airbnb, or other overnight accommodations

- Car rentals

Individual units may impose stricter receipt requirements. For more information on receipt requirements please refer to SPG 507.10-1.

Per the policy on Indirect Cost Recovery, when alcohol is purchased as part of the meal and an itemized receipt is not provided, the entire amount of the meal should be allocated as ICRX.

Business Hosting Guidelines

Business Purpose:

Business meals are those taken with guests, colleagues, or donors during which focused business discussions take place. Business meals with vague, unfocused purposes (such as “to foster collaboration between units”) are not permitted. A valid business purpose is required for all hosting expenses. Recurring hosting that takes place more frequently than once per month has heightened substantiation requirements. A unique dated agenda describing the topics discussed must be provided as documentation for frequent hosting that takes place more than once per month.

Hosting Limits:

Business meal expenses, including non-alcoholic beverages, tax, and tip*, should not exceed the maximum per person allowances of $30/breakfast, $30/lunch, and $70/dinner.

Expenses for alcoholic beverages are limited to $20 per person, per event, including tax and tip*. Alcohol expenses must be flagged with an “X” Class and cannot be charged to General, Federal, or Sponsored funds. Refer to the university’s policy on Indirect Cost Recovery Excluded (ICRX) Expenditures.

Any business meal costs that exceed the maximum allowances must be accompanied by a detailed explanation and have approval from a supervisor or higher-level administrative authority. The expenses, including tax and tip*, that exceed the amounts listed above must be segregated and cannot be charged to General or Federal funds.

The following items are not included in the per-person cost for business hosting:

- Venue deposit/rental

- Linens and decorations

- AV/equipment rental

- Bartender or wait-staff fees (not including gratuity)

For development activities involving hosting donors and recruitment activities involving hosting recruits (faculty, staff, or athletics), expenses for meals and alcohol are allowable at the actual amount incurred. The expense must nevertheless be reasonable from a business standpoint for the type of activity taking place.

*The amount to tip is at the discretion of the unit, though generally 15-20% is typical.

Hosting:

Virtual hosting for student and recruiting events that are held remotely due to extenuating circumstances are considered valid business expenses and thus non-taxable when U-M pays the actual cost of the students’ or prospects’ meals. Providing gift cards/certificates for these events is subject to the University’s policy on “Gifts, Prizes, Awards” (SPG 501.12).

Virtual hosting of employees — sending meals to the homes of employees for virtual meetings or events — is not considered a valid business expense under the institutional interpretation of IRS guidelines for meals.

Meals, reimbursements or gift cards for meals provided to individuals working remotely or in person should be treated as taxable under the University’s policy on “Gifts, Prizes, Awards” (SPG 501.12).

Mileage

At times, a personal vehicle may be used in order to save time, transport equipment, or reduce costs when several people are traveling together on university business travel. Effective January 1, 2025, the mileage reimbursement is 70 cents per mile.

- The origin for business travel mileage is computed from the employee’s U-M unit office location or home address, whichever is closest to the destination.

- The mileage rate for reimbursement accounts for fuel costs as well as wear and tear to a personal vehicle; therefore, costs for fuel or maintenance are not reimbursable.

- Tolls and reasonable parking charges will be reimbursed in addition to the mileage allowance.

- When claiming mileage in lieu of airfare, a coach class comparison from CTP (through the online travel booking tool) at least 14 days in advance of the trip is required with the expense report submission. Mileage reimbursement is limited to the amount of the coach airfare.

NOTE: When traveling by car, mileage reimbursement isn’t always the most economical or safest choice. Renting a car through the university’s preferred suppliers, National and Enterprise, offers well-maintained, low-mile cars at discounted rates for business travel. Use the Trip Optimizer Tool to determine the most cost-effective travel solution.

Local Transportation

The university generally does not pay for:

- Local in-town transportation (eg. travel between university buildings on the same campus for meetings or within the city of the employee’s primary work location), including mileage on personal vehicles, ride-share services, and car rentals for local use (e.g., zip cars).

- Local parking/tolls

- Commuting costs (e.g., the costs associated with driving a car between home and the normal place of work or business)

Mileage exceptions due to job requirements (where travel is extensive and intrinsic to the type of work the employee is expected to do) may be made with approval from the appropriate higher administrative authority and submitted to the Shared Services Center, using the Audit Exception Request Form. When submitting an expense report in Emburse Enterprise, an explanation and rationale for local mileage reimbursement must be entered at the expense line in the comment field.

Policies

See SPG 507.10-1 for the Travel and Business Hosting Expense Policy. The travel and expense policies and procedures apply to all U-M funding sources.

Business expenses, including both PCard and out of pocket transactions (cash or personal credit/debit card), should be submitted on an expense report for approval within 45 days of the transaction date. For travel expenses, an expense report should be submitted for approval within 45 days following the last day of the trip.

FAQ

How do I obtain a copy of a Concur report?

- You will need to use SSO

- The app will automatically open with a list of your own reports from Concur

Are there any payment methods that do not qualify for reimbursement?

Forms

Authorization by Signature

Use the form outlined in the above article to delegate approval authority for transactions pertaining to the PCard, business travel, business hosting, and other expenses. Both the delegator and the assignee must sign the form. Read more about Higher Administrative Authority.